Valuation: How are Assisted Living Properties Valued?

- Supported Living Invest

- Mar 11, 2025

- 2 min read

Any asset—regardless of its nature—that generates a yield double the standard rate and grows above inflation will naturally hold greater value compared to a similar asset that doesn’t.

The valuation methodology for assisted living properties applied here mirrors the approach used for commercial premises, businesses, the freehold of apartment blocks with ground rent, and dividend-paying stocks and shares. The premium over the bricks-and-mortar value arises from the long-term, inflation-proof, passive income it generates, which delivers a strong return on investment (ROI) over the medium to long term.

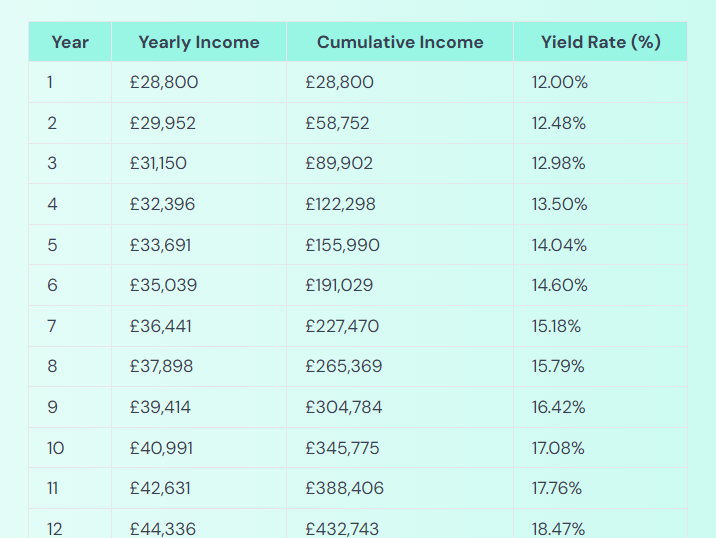

Take, for instance, the calculations below using our online calculator based on a listed price of £240,000:

Over three years (assuming inflation +1% = 4% annually), the yield would total £90,000. This amount offsets any increase in the bricks-and-mortar value, while the ongoing yield rises to 13.5%. Additionally, you would benefit from capital appreciation on the property’s bricks-and-mortar value. After five years, the accumulated yield would reach 65%.

By years 7 or 8, your entire initial investment would be recovered through yield alone. Beyond this, you would retain the bricks-and-mortar equity in the property—which will likely have appreciated significantly—and still hold a management contract with 15 to 16 years remaining, by which time the yield would exceed 15%. Once again, the bricks-and-mortar value would have increased significantly by this point.

It’s natural to view a residential property through the lens of its bricks-and-mortar valuation when making comparisons. However, this asset should be considered simply as an income-generating vehicle, designed to deliver high annual yields—similar to an annuity, but with the added security of being asset-backed. Unless your strategy involves selling the property in the short term at standard bricks-and-mortar value (excluding the management contract), even with the premium, the potential returns could surpass those of purchasing the property for £150,000 and renting it at standard market rates. In fact, it could outperform most other long-term income-generating, asset-backed investments.

If you would like to discuss this, or anything else about assisted living investments, please do not hesitate to get in touch.

Comments